A Brief Overview About: What Is Accumulated Depreciation?

Introduction

What Is Accumulated Depreciation? A piece of equipment's accumulated depreciation is the total of all depreciation costs incurred since it was first put into service. A contra-asset account is a negative investment account used to offset another asset account's balance. The value of a contra-asset account rises as money is credited to it and falls when money is taken out of it, the exact opposite of a traditional asset account.

Every time a corporation incurs depreciation costs, that amount is also charged to the accumulated depreciation account, so the asset's original cost and currency depreciation may be easily determined. On the balance sheet, this corresponds to the asset's net book value. Financial analysts will design a depreciation schedule as part of the financial modelling process to keep tabs on the overall depreciation that an asset will incur over its lifetime.

Understanding Accumulated Depreciation

By GAAP, costs must be recorded in the same fiscal year as the revenue they support. Depreciation is the annual reinvestment of a fixed percentage of the value of a capital asset over the asset's useful life. It guarantees that a capitalised asset is utilised annually, generating income and recording all associated expenses.

Expanded Example

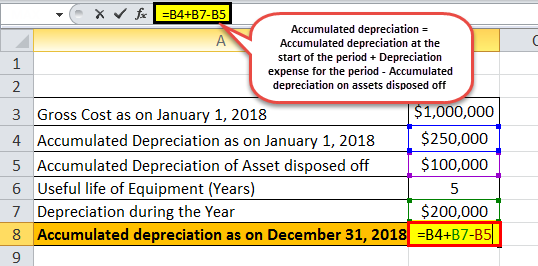

Accumulated depreciation was calculated using the following formula in the preceding example:

- Depreciation Over Time = (Cost - Salvage Value) / (Life of Asset) * (Number of Years)

Our math came up like this:

- Accumulated Devaluation = ($100,000 - $0) ÷ 10 * 2 = $20,000

To this, we must now include the potential earnings from salvage. Salvage value is the estimated value of a depreciated asset. Assuming a salvage value of $5,000, the accumulated depreciation formula would read as follows:

- Accumulated Devaluation = ($100,000 - $5,000) ÷ 10 = $9,500

In the first year of the asset's expected lifespan of ten years, depreciation costs will add up to $9,500. Using straight-line depreciation, the annual depreciation will be $9,500.

Impact of Accelerated Depreciation on Accumulated Depreciation

Since more of an asset's cost is written off as an expense in the first few years of its use, the accumulated depreciation account balance grows more quickly when a company employs an accelerated depreciation approach.

Is Accumulated Devaluation a Recent Asset or Fixed Asset?

To reiterate, depreciation is not a liquid asset. It's not even something that can be considered a fixed asset. Depreciation is the accounting process that spreads the initial investment in a fixed asset out over the asset's expected useful lifetime. This method allows businesses to spread the expense of purchasing fixed assets across several years rather than incurring significant losses in the year of purchase. Due to their short lifespan, current assets are not subject to depreciation.

Recording in Books

Depreciation is recorded by making a debit entry to the general ledger's depreciation account and a corresponding credit entry to the cumulative depreciation account. When the above entry is made, depreciation costs appear on the accounting period's income statement. Below the line on the balance sheet is the accumulated depreciation for the associated capital assets. Depreciation accrues over time, with each period's depreciation expense added to the tally.

How to Calculate Accumulated Depreciation

Calculating a fixed asset's accumulated depreciation is easy by extending the depreciation schedule from the asset's acquisition date to the present day. Depreciation amounts recorded in the general ledger over the asset's life should be checked periodically to ensure that the same calculations were used to record the underlying depreciation transaction. For instance, if an asset experienced an impairment charge, its carrying amount would decrease, and its remaining useful life may be adjusted, which would be reflected in the depreciation calculation and thus affect the amount charged to expenditure every month.

Is Accumulated Depreciation a Current or Long-Term Asset?

Accumulated depreciation is a counter-asset account with a credit balance that appears in the balance sheet's Property, Plant, and Equipment section. The portion of a long-term asset's initial purchase price has been set aside for future use.

Conclusion

The purpose of keeping track of depreciation is to align the expense of operating a long-term capital asset with the benefit obtained from operating it. The total amount of depreciation that has been accounted for up until a given date is known as the asset's accumulated depreciation. On the balance sheet, accumulated depreciation appears below the line for the corresponding fixed asset. A counter asset with a credit balance, by definition, accumulated depreciation is recorded (as opposed to asset accounts with natural debit balances). Cost minus depreciation over time is an asset's carrying value.