The 5 Best Graphene Stocks to Invest in 2024

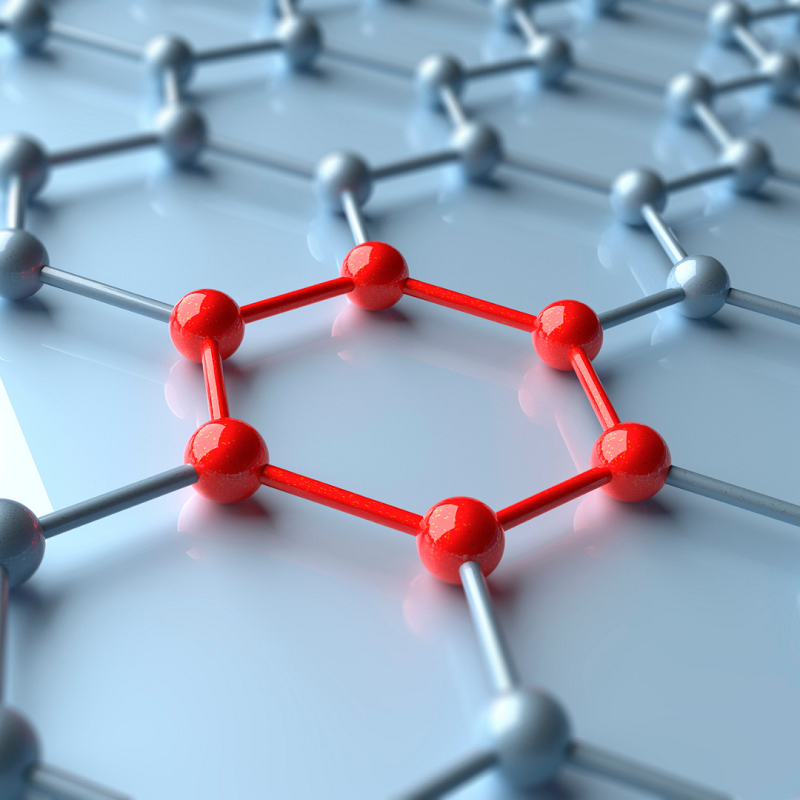

Graphene is an allotrope of carbon known for its strength, conductivity, and flexibility. It is 200 times stronger than steel. According to research by the Royal Society of Chemistry, the atoms of graphene are arranged so tightly that only water molecules can pay through it. Investing in graphene would be new for many investors; let's explore some of the best graphene stocks for 2024.

For companies that want to stand out in this competitive market, utilizing graphene will help them make advanced products. Using graphene in solar panels boosts their efficiency by up to 60%. Graphene is transforming many industries, including healthcare, energy, electronics, conductors, and batteries. Graphene companies and graphene battery stocks will be the next big thing in the coming years.

Top 5 Graphene Stocks to Invest in Now!

For investors, here is the list of 5 names who want to invest in graphene stocks. You can buy these stocks on different exchanges in different countries.

Directa Plus

Directa Plus is a publicly traded stock company based in Italy. It is one of the largest graphene nanoplatelet manufacturers. Its products are natural, chemical-free, and sustainable. They can be used commercially in the composites and textiles industry. The graphene materials produced by the company are scalable and portable.

The company has experienced significant growth since its formation. The company develops and commercializes graphene-based products like goofballs, clothing, footwear, and tires. In 2018, Directa Plus announced its partnership with Arvind Ltd (a textile company) to develop and commercialize graphene-enhanced textiles.

Besides having mechanical properties, these building materials are expected to be environmentally friendly. The company outperformed the market as a whole and continues to show growth potential. These building materials are expected to have mechanical properties and a reduced environmental impact. The company is outperforming and showing exponential growth, with a market cap of $16.514 million.

Archer Materials Limited

Archer Materials Limited develops and commercializes computing chips and semiconductor devices. Founded in 2007 as Archer Exploration Limited, the company's motto is to bring innovative materials to the market and improve human life.

Along with graphene-based materials, the company offers other advanced materials, including copper, manganese, and cobalt, used in batteries, data storage, and sensor devices. Although Archer Materials isn't purely a graphene company, it continues expanding its market footprint.

Archer Materials Limited acquired Carbon Allotropes in 2020. This company focuses on graphene-based materials and technologies. The main goal of this acquisition was to access the allotropes of carbon and produce high-quality graphene. The company also acquired 2D quantum to create and functionalize graphene and other 2D materials. Archer Material Limited's total market value is $123.6 million.

G6 Materials Corporation

The company, previously known as Graphene 3D, was founded in Canada in 2011. Its previous mission was to develop and commercialize graphene-based materials for 3D printing. G6 announced its partnership agreement with Singapore-based MADE Advanced Materials in 2022. The company will produce Graphene-enhanced resins in collaboration with Graphene Laboratories.

G6 Materials now offers graphene at affordable prices for research, commercial, and military purposes. Graphene creates laminated fiberglass and carbon fiber composite materials in the automotive, marine, defense, and aerospace industries.

The demand for advanced materials, including graphene, continues to increase due to the exponential adoption of advanced and electronic vehicles. G6 Material Corporation's market capitalization is $1.22 million.

Applied Graphene Materials

AGM (Applied Graphene Materials) was founded in 2010 in the UK. The company manufactures, disperses, and produces graphene. It formulates graphene applications by integrating products and owns intellectual property rights to the graphene production process.

After graphene is incorporated into products, the applicant's range of products increases. These applications range from manufacturing car polishes and waxes to improving supercapacitors and batteries. They also include formulating thermal adhesive materials and advancing polymers and composites.

It also produces less corrosive coatings and paints due to graphene. Applied Graphene Materials collaborates with James Briggs Limited, a UK industrial paints, bulk chemicals, and aerosols manufacturer. This collaboration aims to develop novel graphene-enhanced coatings. The current market capitalization of Applied Graphene Materials is approximately $1.29 million.

As AGM partners with companies in different sectors to bring innovations to consumers, it leverages its specialization in graphene production. As a result of this collaboration, a graphene-enhanced coating line was developed for James Briggs products. AGM innovates its products by partnering with companies in different sectors. This helps the company establish a distinct market identity and attract more consumers.

Haydale Graphene Industries

It is a UK-based company specializing in developing, processing, and dispersing nanomaterials and graphene for commercial use. Haydale Graphene produces cost-effective graphene for various applications. Based in South Wales, the company provides innovative solutions to the infrastructure sectors and energy storage systems with graphene.

The company was formerly known as Innovative Carbon Limited. By using graphene and specific materials correctly, Haydale Graphene creates products that are compatible with those currently available on the market. The company's market value is approximately $10.24 million. Its well-known products include graphene coatings, inks, resins, and facemasks.

In 2016, EPL Composite Solutions (a well-known manufacturer of advanced composite materials was acquired by Haydale. This investment of the company has given a boost to its consumer base in the automotive and aerospace industries. Innophene Limited, known for making high-performance composites and polymers in the defense and aerospace sectors, was also acquired by Haydale.

Conclusion

Investing in graphene stock would be an excellent experience for those passionate about emerging technology. By understanding graphene's potential usage and properties to make innovative materials, you can align yourself in a rapidly evolving market.

As an investor, you should know that lithium-ion batteries are slowly replacing by graphene batteries, which is transforming the electric vehicle sector. Remember, investing in graphene stocks has similar risks to investing in other stocks. Before investing, consider the risk and reward ratio carefully because the graphene industry is highly volatile.