The Cboe Volatility Index (VIX)?: What You Need To Know

Actual market predictions for both the magnitude of near-term price fluctuations of the S&P 500 Index are reflected inside the What Is The CBOE Volatility Index? Cboe Volatility Index (VIX) (SPX). It creates a 30-day forward prediction of volatility based on the values of options on the SPX index with short-term expiry dates. This Cboe Volatility Index (VIX) is an indicator of market anxiety calculated by the Cboe Options Exchange (Cboe) and published by Cboe Global Markets. Variability, or the rate of change in stock prices, is frequently regarded as a reflection of general market attitude. Given its use in quantifying market risk and investor mood, this indicator is widely used in the trading and financial communities.

The Cboe Volatility Index Definition (VIX)

Cboe Global Markets developed the VIX in 1993 as an index to measure and forecast volatility in the U.S. stock market. Like other indexes, which evaluate performance by following a basket of stocks and perhaps other assets, the VIX measures volatility by following a basket representing securities. It is commonly used as a measure representing stock market volatility around the globe, with higher values in the VIX indicating greater volatility. For the S&P 500, the VIX follows both calls and puts options with expiry dates 30 days from now.

What Is The Cboe Volatility Index (VIX) And How Does It Work?

The movements in the price of S&P 500 options are used to calculate the CBOE Volatility Index, which is then used to gauge market volatility expectations. Venture capitalists can trade derivative instruments based on the VIX, which may be beneficial for many reasons. For instance, if an investor thinks the stock market may become more volatile in the future, those who can buy VIX futures decide to purchase the VIX at a premium price than some of its current price. The VIX is calculated using a complicated formula. Additionally, they may utilize derivatives to make money off a decline in volatility if they believe it will occur. Investors widely use the Volatility Index (VIX) as a hedging tool. The VIX has historically been inversely related to stock market returns.

Is The Cboe Volatility Index (VIX) Necessary?

The VIX is a one-of-a-kind index that enables traders to partake in trading methods that would otherwise be difficult to implement. The VIX provides a means of capitalizing on the expectation of rising market volatility and investor anxiety. The VIX is used by some investors as a gauge of market anxiety and a predictor of stock price movement, making it a necessary tool for those seeking to benefit from volatility in the market. Increasing levels of investor anxiety, as measured by the VIX, are often precursors to stock price declines. You may use the VIX as a valuable indication for other transactions even if you don't invest in VIX-based securities, including derivatives.

What Does This Mean For Individual Investors?

The VIX has several applications for individual traders. A straightforward use is a predictor of overall market behavior. Given that the VIX follows investor mood, following its ups and downs might help you predict the overall market's direction. This has led some people to consider buying direct exposure to VIX. Even though direct investment in the index itself is impossible, investors may still profit from the VIX via the use of derivatives and marketplace products already pegged to the index.

Futures On The VIX

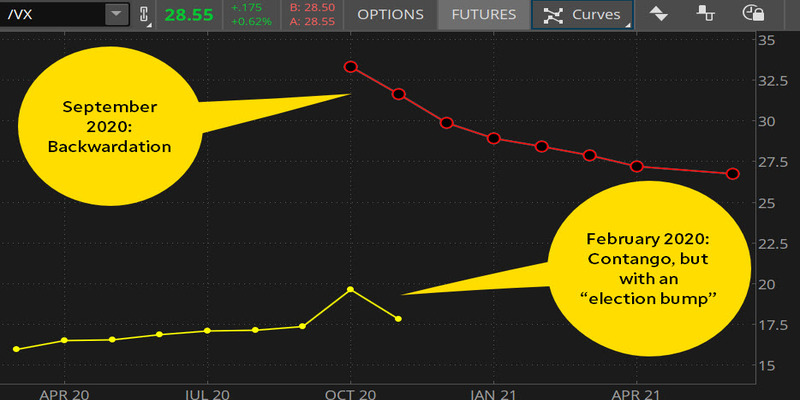

Even while trading derivatives is commonly regarded as carrying a higher level of risk as trading equities, traders of VIX futures frequently face a unique risk known as contango. When VIX futures markets have a higher price than the current VIX and or shorter-term options, the market is said to be in a contango position. Know that just as older contracts end, you will be required to replace them with more expensive ones if acquiring VIX derivative contracts is one of your investing strategies. This is something you should be aware of in advance.

Conclusion

One such statistic that does just that is the CBOE Volatility Index (or VIX for short), which monitors the level of uncertainty in the stock market in the United States. The CBOE Volatility Index (commonly known as the VIX) is an index created to measure the volatility of the U.S. stock market and, more specifically, the predicted volatility of the S&P 500 via call options and put options. It particularly utilizes call-and-put options to mimic the S&P 500's projected volatility.