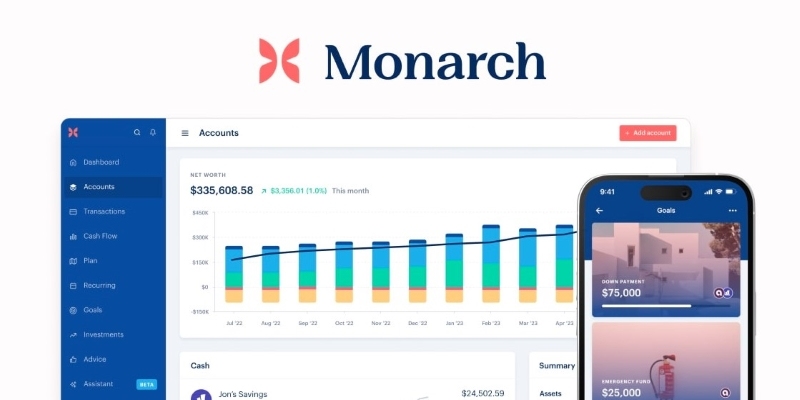

2024 Monarch Money App Review: Your Ultimate Financial Companion

Managing personal finances can be challenging, especially with multiple accounts, bills, and investments to keep track of. Monarch Money aims to simplify this process with its comprehensive financial management app.

This review will dive into what Monarch Money offers, including its features, benefits, pricing, pros and cons, and whether its worth the investment.

What is Monarch Money App?

Monarch Money is a personal finance app designed to help users manage their finances more efficiently. It provides tools for budgeting, tracking investments, and setting financial goals. The app integrates with various financial institutions to offer a holistic view of a users financial health, making it easier to plan and manage money.

Monarch Money App: Features, Benefits, Pricing, and Much More

Features of Monarch Money App

Monarch Money is packed with features that aim to provide users with comprehensive financial management tools. One of its standout features is its bank integration capability, which allows the app to sync with over 12,000 financial institutions. This ensures users have a real-time and consolidated view of their financial status, including checking, savings, credit card accounts, and investments. The apps customizable dashboard enables users to personalize their financial overview, highlighting key metrics and insights that matter most to them.

The budgeting tools within Monarch Money are advanced yet user-friendly. Users can create detailed budgets across various categories, track their spending against these budgets, and adjust based on real-time financial data. Investment performance analysis is another critical feature, providing insights into portfolio performance, asset allocation, and potential optimization areas. This makes it easier for users to manage their investments and make informed decisions.

Another significant aspect of Monarch Money is its goal-tracking functionality. Users can set short-term and long-term financial goals and monitor their progress, which helps them maintain focus and motivation to achieve financial objectives. The Bill Center feature is particularly useful for managing recurring expenses, as it tracks all bills in one place and sends reminders for upcoming payments, ensuring that users never miss a due date.

Benefits of Monarch Money App

Security and privacy are top priorities for Monarch Money. The app employs bank-level encryption and read-only access to financial accounts, meaning it cannot make transactions but only read data, ensuring that user funds remain secure. Additionally, Monarch Money has a strong stance on privacy, promising not to sell user data to third parties, which builds trust and reliability among its users.

The app's customer support is available via email. While the lack of live phone support might be a drawback for some, the responsive customer service team and engaged user community provide substantial support and assistance.

Pricing of Monarch Money App

In terms of pricing, Monarch Money offers a two-week free trial for new users to explore the premium features. Post-trial, the app has a Premium Plan priced at $14.99 per month or $99.99 per year. The yearly subscription offers a cost-effective solution, equivalent to $8.33 per month, providing access to the full range of features, including investment tracking, goal setting, and enhanced security measures. While there is no entirely free version, the flexible subscription plans and the trial period allow users to gauge the apps value before committing financially.

Monarch Money App: Pros and Cons

Pros of Monarch Money App

Monarch Money offers a robust suite of tools designed to help users manage their finances comprehensively. One of the key advantages of the app is its all-encompassing approach, integrating budgeting, investment tracking, and goal setting into one platform. This makes it a one-stop solution for users looking to streamline their financial management. The user-friendly interface is intuitive, catering to individuals with varying levels of financial expertise, making it accessible and easy to navigate.

Additionally, Monarch Money places a strong emphasis on security, employing bank-level encryption and ensuring read-only access to financial accounts, which reassures users about the safety of their sensitive data. The app's customization options allow users to tailor their financial dashboards and budgeting tools to meet their specific needs, further enhancing the user experience. Another notable benefit is the absence of advertisements, which contributes to a cleaner, distraction-free interface.

Cons of Monarch Money App

However, there are some drawbacks to consider. Monarch Money does not offer a fully free version of the app, unlike some of its competitors. This can be a significant downside for users looking for a no-cost option. Customer support is also somewhat limited. No live phone support is available, relying instead on email communication, which might not be as immediate or effective for urgent issues.

Monarch Money App: Is it Worth it?

Monarch Money offers a robust suite of financial management tools that cater to a wide range of users, from beginners to experienced investors. Its user-friendly interface, strong security measures, and comprehensive features make it a valuable tool for anyone looking to gain better control over their finances. The premium plan, while not free, provides excellent value with its extensive feature set, especially for those serious about managing their financial health.

However, potential users should consider their specific needs and compare Monarch Money with other available apps, such as YNAB, EveryDollar, and Tiller, to determine the best fit for their financial management style.

Conclusion

Monarch Money stands out as a versatile and comprehensive financial management app in 2024. With its wide range of features, strong emphasis on security, and user-friendly design, it provides significant value to users looking to streamline their financial management. While the lack of a free version and limited customer support may be drawbacks, the benefits and overall functionality of the app make it a strong contender in the personal finance space.