First-Time Home Buyer Programs in New Mexico

You don't need to be a "first-time" homeowner to qualify as a "first-time" buyer. One must instead not have owned and occupied a principal house within the preceding three years. If so, you may qualify for the New Mexico Mortgage Finance Authority's FIRSTHome program, which can be combined with a conventional loan from the Federal Housing Administration, the Department of Agriculture's Home Finance Agency, or the New Mexico Mortgage Finance Authority.

Borrower requirements:

One must have a credit score of 620 or higher to qualify as a borrower (however, there are various exemptions for alternative credit standards).

Personal funds totaling at least $500 must be used to purchase the home.

Homebuyers are required to go through pre-purchase counseling.

M.F.A. limitations range from $65 520 to $146 970 per year, depending on where and how many people are in your home.

Property requirements:

All properties must fall under the state's maximum financing amount (M.F.A.) limitations, which range from $349,526 to $440,480.

The property type must be a detached single-family home.

You can't turn it into a moneymaker (i.e., not an income or investment property)

Next Mortgage from the M.F.A.

The NEXTHome loan offered by M.F.A. is not limited to first-time buyers; therefore, it is also a viable alternative for those purchasing a "next" home.

In addition, first-time homebuyers with modest or low incomes may benefit from the program. Regardless of location or family size, all borrowers must meet the same income and purchase price criteria that apply to the FIRSTHome program.

Statewide maximum household income is $95,000.

You can't spend more than $346,600 on a home.

Mortgage down payment help in New Mexico.

Down payment help from the Mortgage Finance Agency (M.F.A.)

As an adjunct to its FIRSTHome loan product, M.F.A. also provides a down payment help program called FIRSTDown. Since it can be difficult for a first-time homebuyer to come up with the money for the down payment, FIRSTDown provides a second mortgage of up to $8,000. You can get a second mortgage with the same 30-year term and low-interest rate as your primary loan, and you'll pay it back the same way.

Putting Down on Your Next Home with Help from M.F.A.

If the NEXTHome program is a good fit for you, you can get up to 3% of the purchase price of your first home as a down payment. As long as certain requirements are met, the aid loan does not require monthly payments and can be written off entirely. The aid will be fully forgiven after 15 years, beginning with 20% forgiveness in year 11. The help loan is due if you sell your property or refinance your first mortgage before then.

Help with your down payment from M.F.A. HOMENow.

The HOMENow program provides up to 8% of the purchase price or $8,000 (whichever is less) to help with the down payment and closing expenses if your income is less than 80% of the area median income (A.M.I.) where you are purchasing a house. The balance will be forgiven if you continue to live in and maintain ownership of the property for ten years after taking out this second loan. You must put up at least $500 as a down payment to qualify.

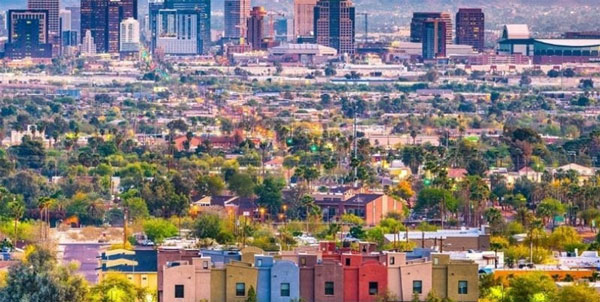

Programs that help people buy homes elsewhere in New Mexico

However, depending on the area where you wish to purchase a house, you may be eligible for additional first-time buyer aid in addition to the help you receive from M.F.A.

For instance, the Santa Fe Community Housing Trust offers a down payment assistance financing program to qualified buyers in the amount of $20,000. Helping those with incomes below 80% of the area median income (A.M.I.), with a particular emphasis on veterans, those with special needs, bigger families, displaced homemaker-headed households, and those with lower education levels.

Diverse First-Time Homebuyer Assistance Programs

F.H.A., VA, and USDA loans, which can be found in Bankrate's guide to first-time homebuyer loans and programs, feature low or no down payments and looser credit standards than conventional loans.

The time has come to initiate action.

Is it the day you finally take the plunge and become a homeowner? Check the income and purchase price limits in the area you're interested in buying a house to determine whether you qualify for one of M.F.A.'s programs. Then, look through the recognized banks, credit unions, and mortgage lenders who can provide you with such a loan. Know where mortgage rates are at present so you can evaluate the competitiveness of various loan providers.